Update On The Market Drop

03.09.2020

The S&P 500 fell 7.6% today as the market reacted to a breakdown in negotiations between two of the world’s largest crude oil producers. Over the weekend, Saudi Arabia and Russia failed to come to an agreement that would curb oil output and support prices in light of the market disruption brought on by Coronavirus. Rather than agreeing to a deal to stabilize prices, Saudi officials announced they would be reducing crude prices further in an effort to take market share from Russia and the United States. Oil prices dropped on the news. Concerns about the impact lower oil prices will have on the U.S. energy industry are adding to ongoing fears about the economic consequences of efforts to contain the Coronavirus. The S&P 500 is now down roughly 19% from the all-time high it made just 19 days ago.

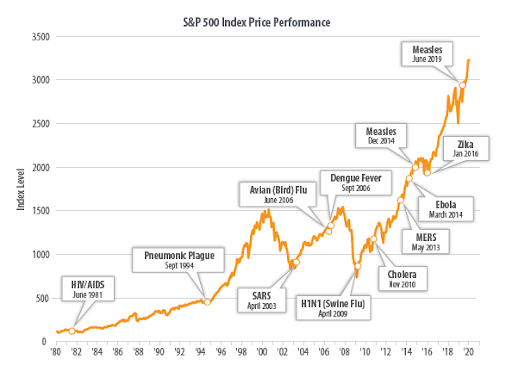

Like past pandemics, the hysteria around the spreading of the Coronavirus will eventually pass. With history as our guide (see chart below), it was our estimation that the market would be able to see through the near term slowdown just as it has done with other major health epidemics in the past. Governments and institutions have taken proactive measures to slow its spread, and while confirmed cases may continue to rise for some time, we believe it poses a relatively limited global health threat over the long-term.

Source: Bloomberg, as of 2/24/20. Month end numbers were used for the 6 and 12-month % change.

Over the coming months, we anticipate more large scale events will be canceled, business travel will be limited, schools closed, and overall confidence indicators will weaken. Some of this demand will undoubtedly be lost permanently and will weigh on corporate profits in the process. The hardest hit industries like hotels, cruise lines, and airlines may very well be forced to lay off employees and right size their businesses.

At the same time, this weekends’ price war within the energy space has altered our view. Lower oil prices, while good for the consumer, could strain the balance sheets of less financially strong organizations just as the global reaction to the virus is likely to slow economic activity. Extremely low oil prices pose a risk to the U.S. energy sector, which has been an important driver of economic growth over the past decade. It is possible that oil prices under $30 a barrel for an extended amount of time will lead to bankruptcies and subsequent layoffs in the energy industry. In addition, the economic footprint of the energy industry is far reaching. Industrial suppliers, financers, and even retailers could see their businesses impacted as activity in the oil patch slows down.

With two significant events now impacting different parts of the economy, an economic slowdown is our base case. The depth of the economic weakness isn’t yet clear, but the odds of a recession are increasing. We do believe, however, a relatively swift recovery could ensue once the spreading of the virus stabilizes. All slowdowns and recessions are not created equal, and in our view this is far from the last recession in 2008-2009.

The biggest difference between now and the recession in 2008-2009 is that this is not a credit crisis, but rather a demand driven event. Consumers, most businesses, and financial institutions are much healthier today than they were 12 years ago. Once the virus is contained, it appears they will be in a position to resume spending with ample access to cheap credit.

Another difference present today is that the Federal Reserve Board and other policymakers have sprung into action quickly. The Fed has already cut the federal funds rate by 50 basis points (0.5%) this year and will likely continue to cut rates further throughout the year. Fiscal policy measures are also being considered that would provide additional support to the economy. A quick response like we’re seeing could go a long way in mitigating long-term damage.

With the odds of an economic slowdown rising, we are making a few changes to move client portfolios to a more defensive posture. We have identified the most economically cyclical companies in client portfolios and are in the process of reducing our exposure to some of them. At the same time, we have been preparing to move towards a few companies with earnings that are less dependent on the ebbs and flows of the broader economy.

We are also watching companies in client portfolios very closely for cues about how they are handling the current environment. In particular, we are watching dividend growth to make sure that companies are delivering growth in-line with our projections. When companies increase their dividends, we view it as a sign of confidence in the long-term prospects of their businesses.

We are not drastically changing any of our portfolios. Our strategies are built with the most difficult economic environments in mind. Only the highest quality companies make it through our rigorous screeners and into the portfolios. We take care to remember that stocks are not prices on a screen, but real live businesses that are more than capable of navigating through difficult times.

We are also not chasing bonds as traders push bond yields lower and prices higher in a flight to safety. We see stocks as the superior asset class given their relative attractiveness vs. bonds. Nearly every dividend paying stock in the S&P 500 now trades at a higher dividend yield than the yield on a U.S. 10-year treasury bond. We believe that investors will ultimately be attracted to high quality companies with growing dividends relative to a bond that pays less and doesn’t grow at all.

We know that times like these can be difficult and we are not downplaying the significance of deteriorating economic growth. However, we take comfort in knowing that our client portfolios are invested in companies that were picked based on the projected Security, Income, and Growth they can provide. The companies we invest in have faced many economic headwinds before, and ultimately have come out stronger in many instances. Despite the heightened uncertainty and growing concerns, we remain encouraged that this time will be no different.

We will stay in close touch with updates as these events continue to unfold, and encourage you to reach out to your Advisor if you would like to discuss further.

Sincerely,

DCM Investment Policy Committee

This report was prepared by Donaldson Capital Management, LLC, a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Information in these materials are from sources Donaldson Capital Management, LLC deems reliable, however we do not attest to their accuracy.

An index is a portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance to certain asset classes. Indexes are unmanaged portfolios and investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. Past performance is not a guarantee of future results. The mention of specific securities and sectors illustrates the application of our investment approach only and is not to be considered a recommendation by Donaldson Capital Management, LLC.

S&P 500: Standard & Poor’s (S&P) 500 Index. The S&P 500 Index is an unmanaged, capitalization-weighted index designed to measure the performance of the broad U.S. economy through changes in the aggregate market value of 500 stocks representing all major industries.