Dissecting the World Economy

In today’s market, stock prices are a function of global economic activity. Nearly all companies are influenced in one way or another by economies beyond their borders. Because of this, investors must understand the key players on the world stage and the relationships between them.

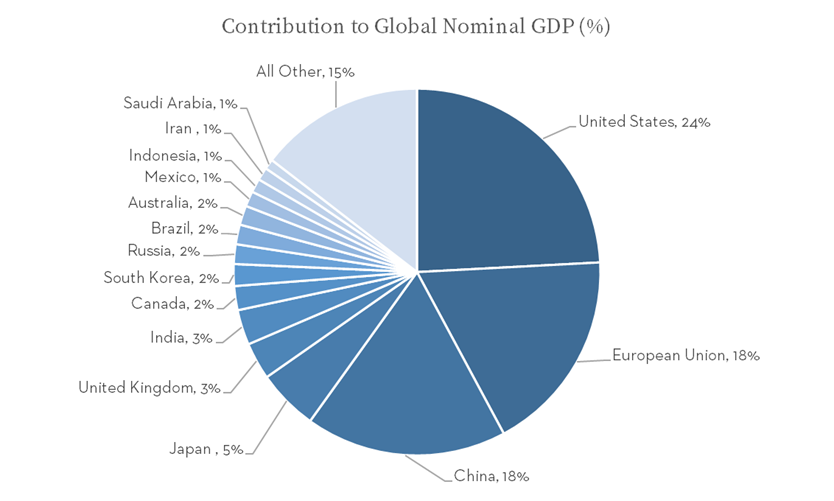

The United States, the European Union, and China are the driving forces of the global economy. Together, they account for roughly 60% of all economic output. With such fiscal might, these entities are naturally interdependent.

The U.S. economy is largely consumer-driven and relies on the EU and China as sources for consumer products and industrial inputs. In turn, the EU and China depend heavily on the U.S. for its financial and technological prowess. China and the EU are also major trading partners for various goods and services.

Because of these relationships, there is a strong correlation between the successes and failures of the three major economies. Strength in one economy often leads to strength in the others and vice versa. However, the U.S. does enjoy a higher degree of insulation due to its consumer slant. It can take much longer for foreign pressure to bleed into the U.S. economy.

Economies outside of the top three are still important in the global economy, but typically do not carry enough weight individually to influence it’s direction. Other than the U.S. or China, no single country contributes more than 5% to global GDP. Strength or weakness within one of these economies does not necessarily translate to the global economy.

However, specific companies or industries could be impacted by the health of smaller economies. As an example, Russia and Saudi Arabia combine for roughly 3% of global GDP, but they have outsize influence on the energy sector because of their productive capacities.

In our strategies, we pay close attention to the geographic distribution of sales and supply chains for our companies. As economies take shape, we can alter our exposure by going global or staying home. We accomplish this by moving the needle on the foreign versus domestic split of sales and/or assets within our portfolios.

This report was prepared by Donaldson Capital Management, LLC, a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Information in these materials are from sources Donaldson Capital Management, LLC deems reliable, however we do not attest to their accuracy.

An index is a portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance to certain asset classes. Indexes are unmanaged portfolios and investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. Past performance is not a guarantee of future results. The mention of specific securities and sectors illustrates the application of our investment approach only and is not to be considered a recommendation by Donaldson Capital Management, LLC.

S&P 500: Standard & Poor’s (S&P) 500 Index. The S&P 500 Index is an unmanaged, capitalization-weighted index designed to measure the performance of the broad U.S. economy through changes in the aggregate market value of 500 stocks representing all major industries.