Estate Planning: A Call to Action

“There is no alternative to advanced planning!” – Colonel George Goodwin, Former INDOT Executive Director, Purdue Alumnus and donor

This call to action, epitomized by the Colonel’s decisive charitable strategy for his beloved Purdue University, stands out as extraordinary in contrast to many who have yet to document their own estate planning preferences.

To get us on the same page, think about your circumstances:

What do you own?

Who are your heirs?

What impact do you want these assets to have on these heirs?

That is estate planning – ensuring that your assets accomplish in the future what your heart desires efficiently and economically.

The most common estate planning error is doing nothing.

Less than half of Americans have a will. That is a lot of folks who are expecting, or at least hoping, that their life’s savings will pass to their preferred heirs. It is true that if you die without a will, then your state’s law will intervene, but numerous factors determine who gets what.

So, why take the risk? Let’s examine.

The Foundation

You should have:

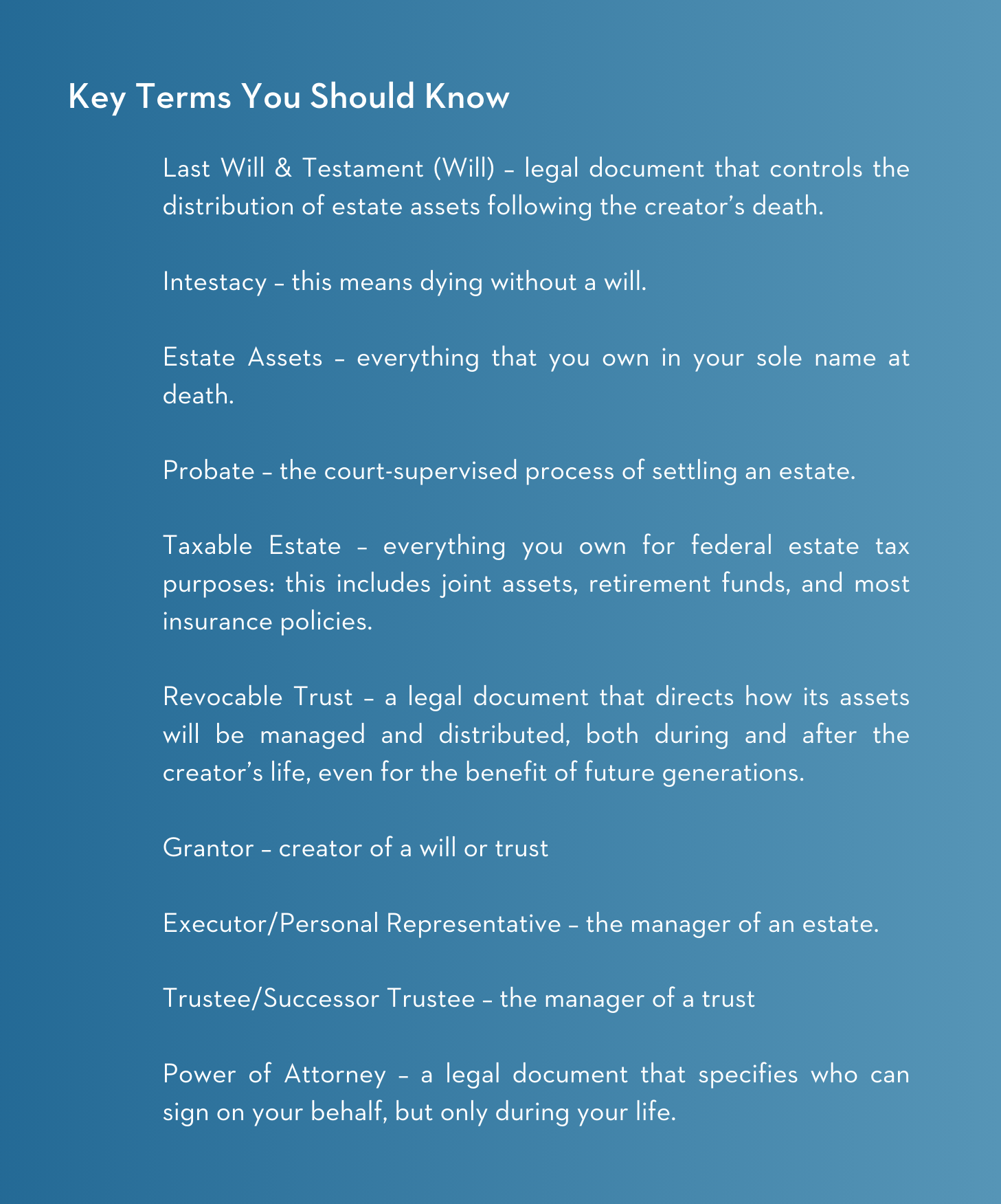

A Last Will & Testament

Power of Attorney

Health Care Directive

Your will should cover several “housekeeping” details, such as paying final expenses (bills, debts, and taxes), who will serve as the executor, and what to do if an heir has predeceased you or is a minor. A well-drafted will not only spells out your preferences, but also anticipates potential circumstances.

If you cannot make business decisions or manage your property, someone you trust should have discretion over your financial affairs. This document also controls under what circumstances the power of attorney can act on your behalf.

Health care directives should be in place when medical decisions need to be made on your behalf. You should make these decisions about your health and about your assets. That requires advanced planning.

But Wait, There’s More!

Revocable living trusts are your friend. For many, the creation of a revocable trust (as opposed to an irrevocable trust) is a better mousetrap.

With a revocable trust:

No loss of control over your assets

More privacy than a probate estate

More economical

More efficient than just a will; both during and after one’s lifetime

Who?

You will need an attorney; one with broad estate and tax expertise, an excellent “bedside manner” and a long-term focus on you and your family. Like most things in life, cost is usually associated with value.

Your will needs an executor; one with sufficient time, expertise, and objectivity. Serving as the executor for a family member or close friend can be a brutal, thankless job. An estate settlement with no family conflict is rare. My advice: use a professional.

If you create a revocable trust, you can be your own trustee during your life while you have the physical, emotional, and intellectual capacity. However, eventually, a successor trustee must step into your shoes.

Your successor trustee will be the quarterback, coordinating the settlement process or the ongoing administration of your assets with your trusted advisors (attorney, CPA, investment advisors, insurance agent, business partners, etc.) and your family.

Estate planning is not a singular event. You should plan to meet with your attorney every 3-5 years or if any significant changes occur with your assets or family.

The cost of not planning can be substantial, both in money and family peace of mind. Plan ahead, be intentional, and make it a priority.

And we are here to help, always just a phone call away.

Remember, “there is no alternative to advanced planning.”

This report was prepared by Donaldson Capital Management, LLC, a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Information in these materials are from sources Donaldson Capital Management, LLC deems reliable, however we do not attest to their accuracy.

An index is a portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance to certain asset classes. Indexes are unmanaged portfolios and investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. Past performance is not a guarantee of future results. The mention of specific securities and sectors illustrates the application of our investment approach only and is not to be considered a recommendation by Donaldson Capital Management, LLC.

S&P 500: Standard & Poor’s (S&P) 500 Index. The S&P 500 Index is an unmanaged, capitalization-weighted index designed to measure the performance of the broad U.S. economy through changes in the aggregate market value of 500 stocks representing all major industries.