What is a Qualified Charitable Distribution?

What is a Qualified Charitable Distribution (QCD)?

A Qualified Charitable Distribution, or QCD, is a tax-free donation from your Individual Retirement Account (IRA) to a charitable organization. To qualify, you must be 70 ½ or older. Aside from supporting charities, QCDs have notable benefits compared to ordinary charitable contributions that could significantly reduce your overall tax bill.

How QCDs Work

Anyone who meets the age requirement can opt to make a QCD; however, if you are required to take distributions from your IRA, a QCD can help reduce what you pay in federal taxes. QCDs may be issued from IRAs and Inherited IRAs. SEP & SIMPLE IRAs are also eligible so long as they are inactive (meaning contributions are no longer being made). Employer plans, such as 401(k)s, are not eligible for QCDs.

The gift must be made directly from your IRA to the eligible charity. The IRA owner cannot receive the funds and then write a check.

Not all charities qualify for QCDs. A charity must be a 501(c)(3) organization that is eligible for tax-deductible contributions. Donor-advised funds and private foundations are not qualifying charities.

Qualified charitable distributions can lower your tax liability in two ways:

Lower Taxable Income: Unlike regular withdrawals from your IRA, QCDs are not counted as taxable income. Instead, QCDs can be deducted from your gross income on your tax return. However, they cannot also be claimed as an itemized charitable deduction. A lower gross income may reduce your total taxes, including the income tax you pay for social security benefits. Additionally, a lower gross income could potentially reduce surcharges on Medicare premiums.

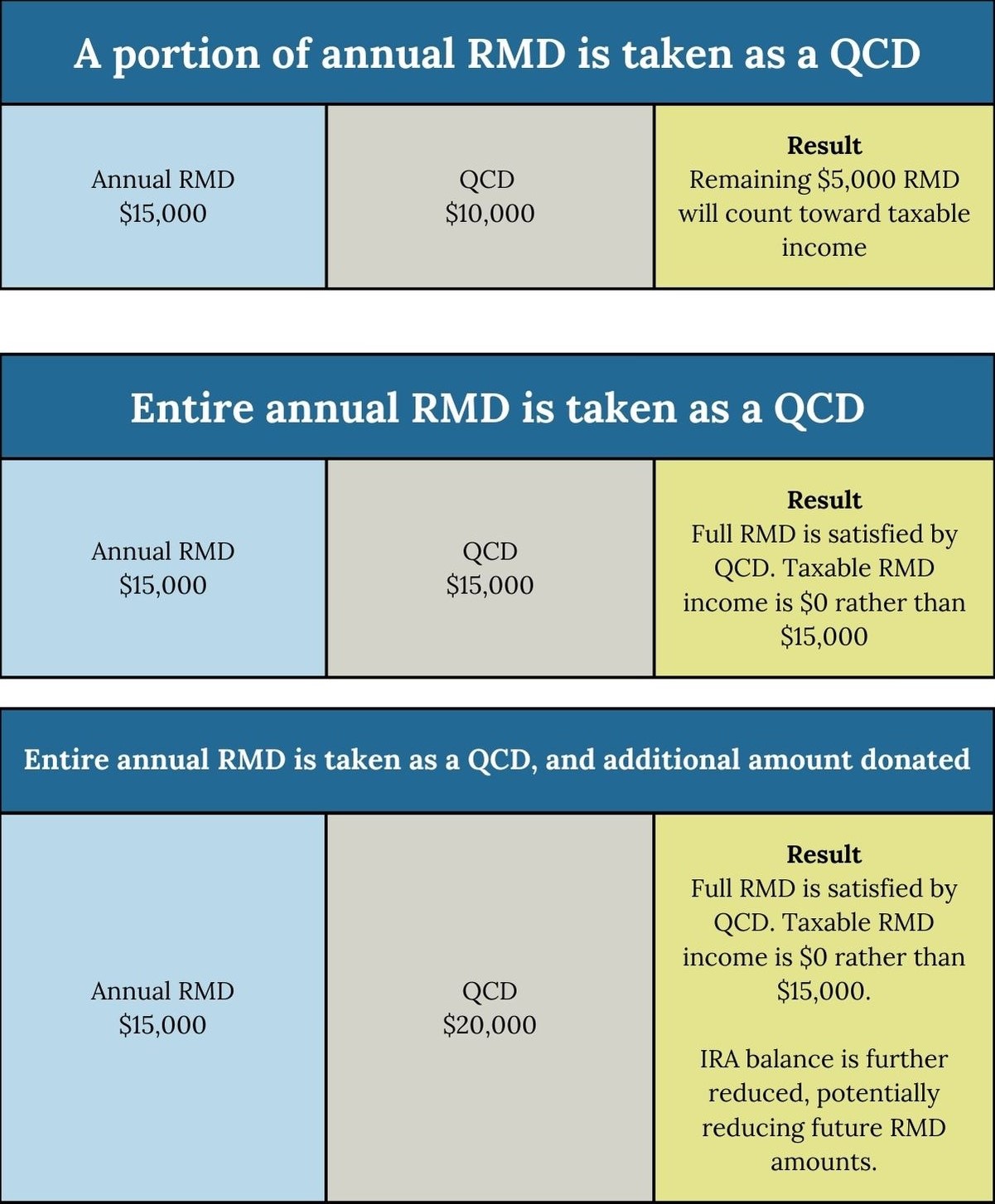

Count toward your Required Minimum Distributions (RMDs): Taking RMDs from traditional IRAs increases your taxable income and, depending on your situation, can push you into a higher tax bracket. Since QCDs count toward your annual RMD, they could fulfill all or part of your RMD without increasing your taxable income.

Filing Taxes with a QCD

Your IRA custodian reports a QCD as a normal distribution on IRS Form 1099-R for a non-inherited IRA. It will be reflected as a death distribution for inherited IRA accounts. There is no code indicating a QCD on your tax form. Ensure you receive an acknowledgment letter from the charity for your gift and notify your tax professional of your annual QCD amount. This will ensure it is correctly reported on your income tax return and that you do not pay taxes on your QCD amount.

Working with your DCM Advisor

We’re happy to assist you in evaluating how QCDs fit into your financial planning. If you are thinking about making a QCD or have any questions about how this giving option can benefit you, please contact your DCM Advisor. We're here to support you however we can and guide you toward financial success.

The table below details how taking a QCD reduces taxable income.

Click here to access print-friendly article.

*This report was prepared by Donaldson Capital Management, LLC, a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. All information is strictly as of the date indicated and does not reflect positioning or characteristics averaged over any period. All information referenced is for strictly information purposes only, and this piece should not be construed as a recommendation to purchase or sell the security referenced. Investing in any security, including the securities presented in this presentation, involves the potential loss of principal, and past performance it not necessarily indicative of future results.

This report was prepared by Donaldson Capital Management, LLC, a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Information in these materials are from sources Donaldson Capital Management, LLC deems reliable, however we do not attest to their accuracy.

An index is a portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance to certain asset classes. Indexes are unmanaged portfolios and investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. Past performance is not a guarantee of future results. The mention of specific securities and sectors illustrates the application of our investment approach only and is not to be considered a recommendation by Donaldson Capital Management, LLC.

S&P 500: Standard & Poor’s (S&P) 500 Index. The S&P 500 Index is an unmanaged, capitalization-weighted index designed to measure the performance of the broad U.S. economy through changes in the aggregate market value of 500 stocks representing all major industries.